d5s14

archive > archive documents

The Port of Hong Kong

Past, Present and Future

Maritime

Money - Hong Kong vs The World

IntroductionGood afternoon ladies and gentlemen and thank you for the opportunity to

address you on the topic of the shipping finance markets in Hong Kong as they

were, as they are now, and as we expect them to be in the future. Before I can

address the subject directly, I need to reflect a little on the industry itself which

gives rise to the need for the provision of financial services. Having direct

involvement with the industry for only the past 15 months, I am reasonably well

qualified to provide my own views on the present and future, but have needed to

rely on the experiences of my colleagues to address the past which has taught us

all many a valuable, and sometimes costly, lesson. My personal observations

after such a short time in the industry convince me that Hong Kong has many

advantages over its competitors in all facets of shipping services and I will

address these as we go forward.

In November 1997, the HK Shipowners Association delegation, under the

Chairmanship of George Chao, visited Premier Li Peng in Beijing to discuss the

future of shipping in Hong Kong. Premier Li was most supportive and saw

shipping as essential to the development of finance and trade and predicted that

Hong Kong would have a bright future as an international free port and shipping

finance centre. The Minister of Commtmications, Mr Huang Zhen Dong,

expressed to the same delegation that Beijing supported the continuation of

Hong Kong as the Asian regional centre for shipping. With the entiy of China

into the WTO, these statements made 4 years ago bear even more applicability

and will help to underpin the Hong Kong industry, albeit with increasing

competition from Shanghai and other mainland port cities.

When comparing Hong Kong to the rest of the world, we should

remember that the history of international shipping in Asia and Hong Kong is

quite young compared to Europe. In 1960, Hong Kong owners barely owned 1m

dwt of ships and only since then did the regional owners acquire

ocean going

tomiage for international trade.

The development of the debt and equity markets in Asia is a

comparatively new phenomenon and these markets, until recent times, lacked

the size and sophistication of the markets in the United Kingdom, mainland

Europe and the United States. The shipping markets themselves have some

fundamental structural differences, with the European markets (apart from

Greece) being more focussed on large corporate structures, and the Asian market

still being driven to a large extent by family concerns. Each of these models has

entirely different financing structures and financial services needs.

tomiage for international trade.

The development of the debt and equity markets in Asia is a

comparatively new phenomenon and these markets, until recent times, lacked

the size and sophistication of the markets in the United Kingdom, mainland

Europe and the United States. The shipping markets themselves have some

fundamental structural differences, with the European markets (apart from

Greece) being more focussed on large corporate structures, and the Asian market

still being driven to a large extent by family concerns. Each of these models has

entirely different financing structures and financial services needs.

Before we try to make comparisons, it is important to Lmderstand that

shipping finance, as is the industry which it funds, is a global product and can be

delivered from any major money centre. Given developments in communication

over the past decade, it is no longer absolutely necessary to have a physical

presence in the domicile of the borrower if a financier is to develop his book and

provide the required facilities. There are however, downsides to the

development of relationships from this remote control approach, but

nevertheless, it still works to a certain extent. It is not a structure to which we at

Wayfoong Shipping Services subscribe, but other institutions have enjoyed

some limited success utilising this remote control approach, however I fear that

they will be unable to continue with this model in the foreseeable future.

The global finance industry is somewhat fiagmented and it is difficult to

obtain accurate figures as to the true extent of the financings which have been

provided in various centres.

The current size of the global market is estimated at USD62bn (as at end

2H0l) of which around 65% is held by the German banks who have been able to

build their portfolios through the success of the KG scheme, and their need to

diversify away from geographic (ie domestic German) risk and vessel type (ie

container) risk.

Global portfolios have grown by an estimated 3.9 times over the past

decade.

Hong Kong is holding its own in the global scene with USD12.3bn in

outstanding loans to the industry (20% of global total) and a growth factor of 3.

The Past

In the mid eighties, the shipping industry was over built and over banked

with the owners blaming the banks for offering money too cheaply, the banks

blaming the yards and their governments for over capacity, and the

yards

blaming the owners for placing the orders in the first place. It is interesting to

see how history repeats itself with such monotonous regularity and with over

orderings now evident in many sectors, we can expect to hear the same plaintiff

cries of distressed owners from all over the globe.

blaming the owners for placing the orders in the first place. It is interesting to

see how history repeats itself with such monotonous regularity and with over

orderings now evident in many sectors, we can expect to hear the same plaintiff

cries of distressed owners from all over the globe.

Before the crash of the mid eighties, there were numerous banks and

finance houses engaged in ship finance in Hong Kong. Restructuring of two

major transactions in late 1986 involved 70 creditor banks and created a major

shake out in the ship finance market thus reducing loan supply quite

dramatically. Following this restructuring period, the supply of finance to the

shipping industry was lefl to a small group of banks with Wayfoong Shipping

Services holding a 70% market share. The Japanese banks had withdrawn

completely and the Gennans had not yet ventured into the market, preferring

their own domestic market. Borrowers came to understand the importance of the

relationship with their bankers and few have forgotten their fair-weather friends

of the 80s despite the recent temptations of highly geared and low priced finance

offerings which are evident in the market.

On a global basis, a similar scenario existed. The high point of participant

activity was probably reached in 1996 when over 200 institutions were involved

in ship finance, with this number reducing to approximately 130 now active. Of

these, the major lenders to the industry probably comprise no more than 35

banks.

In Europe, the numbers are quite dramatic with a reduction from over 100

in 1998 to just 72 currently however the nmnber of German and Dutch banks

has remained relatively stable but the majority of UK banks have withdrawn. In

the Far East, the number of active lenders has reduced from more than 50 pre

Asian currency crisis to somewhere below 40 of cmrent times

The reasons given for these withdrawals have been:

. Poor risk/reward profile offered by ship financing

.Record rate of consolidation within the international banking industry

. The heavy capital requirements of the shipping industry and the 100%

equity risk weighting

. The relative attractiveness of other areas of lending

The same factors have influenced major lending institutions to temper

their exposure to shipping fmance.

In Hong Kong we have 163 fully licensed banks of which only 36 are in

any way active in the shipping markets. Of interest to note, of the 43 Chinese

mainland and locally headquartered banks operating in Hong Kong, only 4 are

active in the shipping markets, thus highlighting the general lack of appetite for

shipping finance amongst the local banks.

Whilst the number of participants has fallen sharply, the capacity

available to the market has not fallen by anywhere near the same extent, and in

all probability has probably increased. There is a greater emphasis on quality

and size as well as age of asset and this has resulted in a major shift towards

newbuilding financing and correspondingly higher loan limits.

Whilst the number of participants has fallen sharply, the capacity

available to the market has not fallen by anywhere near the same extent, and in

all probability has probably increased. There is a greater emphasis on quality

and size as well as age of asset and this has resulted in a major shift towards

newbuilding financing and correspondingly higher loan limits.

The Present

With the recovery in the shipping markets in 1990/1991 there has

been

some renewed enthusiasm from lenders to build their shipping books again

although there is a lack of evidence of new participants entering the market.

some renewed enthusiasm from lenders to build their shipping books again

although there is a lack of evidence of new participants entering the market.

Ship owners have become much more sophisticated in their approach to

funding and market risk and are seeking more than a traditional stand alone

mortgage to provide their financing needs. More and more are looking into the

syndicated loan market to ftmd expensive newbuilding projects and lenders are

supportive of this market in order to minimise risk exposures and concentrations.

This syndicated market is extremely active and over the past 10 years has

enabled USD34bn of new loans (in total) to be booked in Asia. Last year there

were 47 transactions completed at an average loan value of USD47.8m and to

date this year, there have been 31 transactions completed at an average of

USD3lm each. The high volumes in 2000 are reflective of the high level of

newbuild orders placed for delivery in 2002 and onwards.

The utilisation of currency and interest rate risk products is commonplace

in the majority of financings, and owners are looking at every possible which

way to reduce their operating and financing costs, and to bringing some

predictability to a very volatile and cyclical industry.

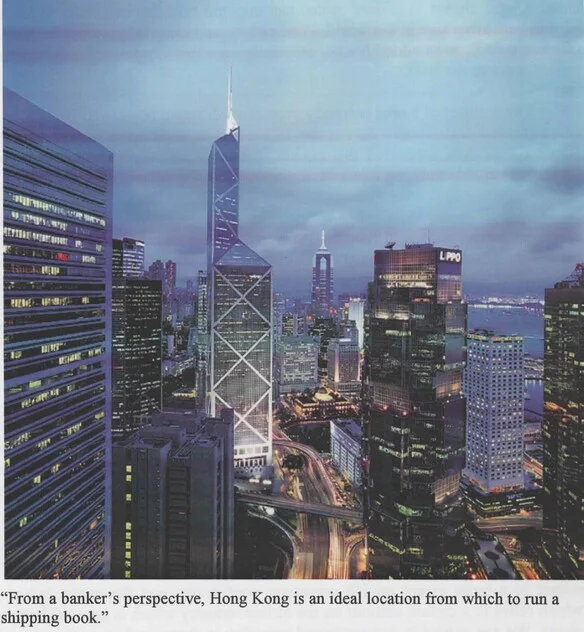

From a bankers perspective, Hong Kong is an ideal location from which

to run a shipping book. Placed squarely in the middle of the time zones, and

therefore able to relatively easily communicate with Europe and the US, a

structured legal system supported by a strong and proactive Admiralty Court,

availability of a large cross section of brokers, ship managers, surveyors and

insurers, and access to a deep water harbour and port infrastructure which is

hard to beat anywhere in the world. Proximity to and knowledge of the mainland

Chinese market is an added bonus, especially now that China (and Taiwan) has

gained entry to the WTO.

The number of banks currently providing shipping finance in Hong Kong

has increased dramatically during the 1990s and in addition to those stalwarts

who have always supported the market, there are many competitors for the

business available in I-long Kong itself and the Asia/Pacific region.

Ship financing is still seen by many credit “experts” as high risk business

which requires specialised lending skills and access to substantial

volumes of

market information. The latter two are truisms however in our experience of the

Hong Kong and Singaporean markets over the past 10 years, the facts do not

support the high risk side of the business as in what other capital goods markets

are lenders provided with hard asset security which is readily saleable, and

easily identifiable cash flows derived fiom these securities through charterhire

and similar incomes.

market information. The latter two are truisms however in our experience of the

Hong Kong and Singaporean markets over the past 10 years, the facts do not

support the high risk side of the business as in what other capital goods markets

are lenders provided with hard asset security which is readily saleable, and

easily identifiable cash flows derived fiom these securities through charterhire

and similar incomes.

It is traditionally a low margin game when compared to property

financing or working capital fmancing, and the impact of the Asian currency

crisis on bank balance sheets in the late l990s, saw many banks readdress their

lending policies and concentrate more on those higher return opportunities

which would facilitate a rebuilding of profitability and balance sheet strength.

As a result, the non-specialist shipping banks withdrew from the market.

The tragic events of September 11 have put more uncertainty into a

number of the shipping markets, especially the container business, which is

reliant to a large extent on US consumer confidence, and the cruise industry

which relies to a certain amount on the airline industry which is now in absolute

chaos. We can expect to see continued volatility in these markets with reducing

profit margins and possibly some failures which could expedite the pace of

consolidation within various industry sectors. The capital markets have become

stagnant since 911 with bond issues being pulled from the market and equity

issues trading way below offer price of the original float. Fund managers are

sitting on their hands thus killing the secondary trading market, and this has a

definitive flow on effect to the primary market. The high yield bond market is

virtually dead as is the equity market for new issues. As Lloyds List quote in a

recent issue, “You couldn’t float a cork in this market”.

The global economies are slowing and many are in recessionary phase

which hopefully will be short lived. My crystal ball is broken so I do not wish to

make any hard and fast predictions of an economic nature, but in seeking

guidance from several well respected economists, I now have several totally

different views on which to make judgements on business opportunities. The

only certainty is that we can continue to see change and nothing is carved in

stone. The ability to adapt to changing market circumstances and to take

advantage of opportunities as they arise will differentiate the owners and

financiers of today and the survivors of the future.

Since the Asian currency crisis, there has been a reluctance in the retail

investment markets to invest in equities and properties for fear of

capital loss.

This is especially true in the Hong Kong market where negative equity in real

estate investments has limited the borrowing power of investors to access and

trade within the equity markets. Many small investors prefer to stay in safe cash

and as a result, the liquidity of the better capitalised banks has never been

stronger. This provides opporttmities to lend, although there are dangers with

maturity mismatches for the ship financiers as long term assets (10 year shipping

loans) are funded from short term deposits. This makes life very interesting for

the risk and liquidity managers within the banking system as these mismatches

are hard to cover and provide some sleepless nights for the portfolio managers

and traders.

This is especially true in the Hong Kong market where negative equity in real

estate investments has limited the borrowing power of investors to access and

trade within the equity markets. Many small investors prefer to stay in safe cash

and as a result, the liquidity of the better capitalised banks has never been

stronger. This provides opporttmities to lend, although there are dangers with

maturity mismatches for the ship financiers as long term assets (10 year shipping

loans) are funded from short term deposits. This makes life very interesting for

the risk and liquidity managers within the banking system as these mismatches

are hard to cover and provide some sleepless nights for the portfolio managers

and traders.

The Future

The HK SAR Govermnent in recent statements following the

Chief

Executives Policy Address of October 10”‘ has restated its commitment to the

shipping industry albeit in somewhat less than specific tenns. The Financial

Secretary has stated that the government will continue to build on the synergy

between the port and shipping industries to strengthen Hong Kong’s position as

a world class port and an international shipping centre. Efforts will be focussed

to enhance our strengths by streamlining the procedures to attract shipping

business to Hong Kong and promoting the attractiveness of Hong Kong as a

can-do port and can-do shipping centre. The growth in the Hong Kong Shipping

Register to 13mn GT reflects the success of such policies in the past and their

ongoing applicability.

Executives Policy Address of October 10”‘ has restated its commitment to the

shipping industry albeit in somewhat less than specific tenns. The Financial

Secretary has stated that the government will continue to build on the synergy

between the port and shipping industries to strengthen Hong Kong’s position as

a world class port and an international shipping centre. Efforts will be focussed

to enhance our strengths by streamlining the procedures to attract shipping

business to Hong Kong and promoting the attractiveness of Hong Kong as a

can-do port and can-do shipping centre. The growth in the Hong Kong Shipping

Register to 13mn GT reflects the success of such policies in the past and their

ongoing applicability.

In the finance sector, looking forward, it seems unlikely that the number

of banks that are active in the market will increase. With shipping investments

getting larger and more specialised, there are considerable barriers of entry to

new palticipants.The new Basle regulations are causing a number of banks

difficulties in evaluating their shipping portfolios particularly on the basis of the

low returns which are historically available on ship finance projects. The

selection of credit through both intemal and external rating processes will focus

banks on the returns which they are able to achieve and the level of capital

which must be provided to generate these returns. In this scenario, the concept

of the one stop shop becomes much more important if acceptable returns for

bank shareholders are to be available.

Some of the traditional ship finance banks are no longer able to compete

effectively for traditional finance business as they have limited mechanisms to

enhance their yields through the provision of non-fimds services such as

Payment & Cash Management business, risk hedging products, basic business

banking, and investment banking activities.

Whether or not banks are prepared to maintain specialised ship finance

operations which require a different set of skills to other corporate lending

businesses, remains to be seen. It is my opinion that banks in Hong Kong will

continue to do so, as shipping, and related industries, is such an integral part of

the local economy. With the opening up of the mainland Chinese market, new

opportunities will emerge and these will require specialist funding.

There will always be a place for a traditional ship lender where the

corporatisation of the industry occurs at a slower pace than in other areas.

Access to the bond and equity markets is available, and facilities are regularly

structured in the sophisticated Hong Kong market, however these markets are

not the playground of the family owned shipping company which wishes to limit

the amount of information given to the market on its own operations and where

profitability is cyclical and unsustainable over the longer term. As we progress

in time, and the patriarchs of these family concerns pass control of their

companies to the next generation, there will undoubtedly occur mergers and

acquisitions which will take these companies to the next stage of development,

or see them disappear from the industry completely. As the structure of the

shipowners changes, so must the focus of the ship financier and thus we can be

sure that change will be the driving force over the next few years.

Hong Kong lacks some competitiveness in the tax effective structured

market where large transactions are being booked under UK and Dutch tax lease

structures which provide accelerated rates of depreciation for shipowners. Given

the tax regime in Hong Kong, it is unlikely that we will be able to offer similar

facilities in the foreseeable future and therefore we will be precluded fiom a

market which has provided in excess of USD1bn in UK taxed based structures

over the past 12 months.

On the positive side, Hong Kong has the resources in terms of systems

and expertise to deliver the next generation fmancing products and innovative

financing structures which will be required to meet the needs of the professional

ship owner. The securitisation of receivables cash flows and charterhire income

is just one method which can offer attractively priced ftmding.

The investment community has had a traditional love hate relationship

with the shipping sector where lack of good analytical resources, single digit

returns, poorly performed stocks, and distressed bond issues has limited

investment appetites. This will not change in the near future and thus underpins

the need for access to shipping finance through traditional sources, an area

where Hong Kong can proudly hold its head on high.